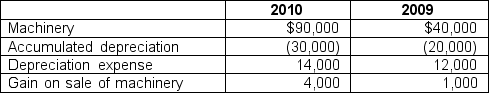

The following information was taken from the records of Albert's Fine Coffee:

During 2010, machinery with a cost of $16,000 was sold.

During 2010, machinery with a cost of $16,000 was sold.

Based on this information, how much cash was collected on the sale of the machinery during 2010?

a. $10,000

b. $20,000

c. $4,000

d. $16,000

Definitions:

Limited Partner

An investor in a partnership who has limited liability to the extent of their investment and does not partake in day-to-day management.

General Partner

An owner of a partnership who has unlimited liability and is responsible for the management of the partnership.

Liability For Firm Debts

Obligations a company must meet, including all debts and financial responsibilities.

Agency Cost

Costs that arise from conflicts of interest between managers and shareholders within a company.

Q13: Which two uses consume most freshwater in

Q28: Harrison Inc. issues community concert season tickets

Q42: Which of the following processes CANNOT form

Q64: Torrey Corporation issued $1,000,000 of ten-year, 10

Q65: What does the associated graph indicate about

Q75: The most common geologic setting of diamonds

Q77: From the answers provided, choose the type

Q88: Which of the following features are generally

Q92: Which of the sites on this cross

Q125: Which of the features on this aerial