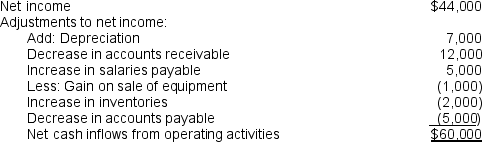

Presented below is a partial statement of cash flows for Santiago Company for the year ending June 30,2009.

Mr. Santiago, the president of the Company, is puzzled by why a difference exists on the statement presented above, as compared to the company's income statement for the same period that shows net income of $44,000. Provide justification why the two amounts might not be equal.

Mr. Santiago, the president of the Company, is puzzled by why a difference exists on the statement presented above, as compared to the company's income statement for the same period that shows net income of $44,000. Provide justification why the two amounts might not be equal.

Definitions:

Marginal Tax Rates

The rate at which the last dollar of income is taxed, reflecting the percentage of tax applied to your income for each tax bracket in which you qualify.

Interest Income

Earnings generated from the lending of money or from deposit funds in interest-bearing accounts.

Eligible Dividends

Dividends designated by a corporation to be eligible for a lower tax rate on the dividend income received by an individual shareholder.

Tax Paid

Refers to the total amount of taxes remitted to the relevant tax authorities for income, sales, property, or other forms of taxes.

Q14: What is a braided stream?<br>A) A stream

Q17: On January 1, a 3-year, $1,090 non-interest-bearing

Q19: The following information was taken from the

Q27: At which sites would this stream profile

Q32: How is interest expense calculated according to

Q43: On December 31, 2010, Cocoa Incorporated had

Q60: On January 23, Borders Corporation purchased 1,000

Q69: A corporation generated assets by issuing equity

Q75: Financial instruments that are not listed on

Q100: Which of the following is most likely