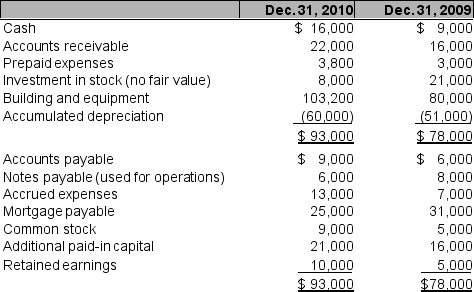

Richards Inc. presented its comparative financial data and other data as follows:

Additional information:

Additional information:

1. Equipment was purchased for $43,200 and was paid in cash. Other equipment was sold at a $3,000 gain and was 50% depreciated at the time of sale.

2. During 2009, Richards Inc. declared and paid cash dividends.

3. Part of the investment in the stock portfolio was sold at book value. The stock is closely-held so no fair value adjustments are made.

4. Net income was $49,000.

Prepare a statement of cash flows using the indirect method for 2010. You may omit the heading.

Definitions:

Common Stocks

Equities that represent ownership shares in a corporation, giving holders voting rights and a claim on a portion of the company's profits through dividends.

Portfolio Beta

A measure of the overall market risk or volatility of an investment portfolio relative to the market as a whole.

Common Stocks

Equity securities representing ownership shares in a corporation, giving holders voting rights and a claim on profits.

Risk-Free Rate

The theoretical return on an investment with no risk of financial loss, typically represented by the yield on government securities.

Q11: The following year-end totals were taken from

Q17: Immediately before a 3-for-1 stock split was

Q23: This figure shows the moon at four

Q26: Which of the following is the most

Q62: On January 1, 2009 Frank Corporation issued

Q74: The visible surface of Uranus and Neptune

Q93: Jake Company borrowed $100,000 from Guaranty Trust

Q101: What is NOT true about how terraces

Q110: Which of the following is true about

Q117: The Favre Company made the following expenditures