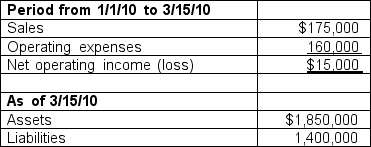

Gleeson Industries consists of four separate divisions: compressed wood products, chemicals, stone products, and plastics. On March 15, 2010, Gleeson sold the chemicals division for $625,000 cash. Financial information related to the chemicals division follows:

If the income tax rate for the company is 35%, what amount of income tax liability on the disposal of the business segment will be recognized?

If the income tax rate for the company is 35%, what amount of income tax liability on the disposal of the business segment will be recognized?

a. $218,750

b. $61,250

c. $5,250

d. $157,500

Definitions:

Equilibrium Price

Equilibrium Price is the price at which the quantity of a good or service demanded equals the quantity supplied, resulting in market balance.

Equilibrium Quantity

The quantity of goods or services that is supplied and demanded at the equilibrium price, where demand equals supply.

Non-collusive Oligopolist

A firm in an oligopoly market structure that independently sets prices and output levels without secret agreements with competitors.

Marginal Cost

The increase in cost that comes from making one more unit of a product or service.

Q22: Warranties should be accrued if it is<br>A)

Q25: On January 1, a 6-year, $5,000, non-interest-bearing

Q27: Which feature on Earth's moon is the

Q37: Which one of the following is not

Q40: Intangible assets differ from plant assets in

Q48: What sedimentary rock is composed primarily of

Q67: Julia Used Cars offers a one-year warranty

Q73: Investments in equity securities are current assets

Q80: On the income statement, interest revenue is

Q83: Which of these four numbered features on