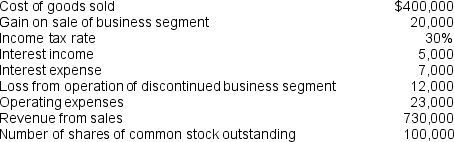

Jarvis Company provided the following information for the year ending December 31, 2009:

Prepare an income statement in good form. You may omit the heading. Include all earnings per share amounts required for the year ending December 31, 2009.

Prepare an income statement in good form. You may omit the heading. Include all earnings per share amounts required for the year ending December 31, 2009.

Definitions:

Lease Payment

Regular payments made by a lessee to a lessor for the use of an asset for a specified period as outlined in a lease agreement.

Lease Payment

Payments made by a lessee to a lessor for the use of a leased asset, typically defined in the lease agreement and paid over the lease term.

Interest Revenue

Income earned on investments, loans, and other interest-bearing financial assets, reflecting the cost paid to the entity for the use of its funds.

AASB 16

The Australian Accounting Standard Board 16 specifies the principles for the recognition, measurement, presentation, and disclosure of leases, both for lessees and lessors.

Q10: What are 'off-balance sheet risks'? What disclosures

Q25: Identify types of transactions that are considered

Q27: Intangible assets can be divided into two

Q29: The difference in computing the effective interest

Q33: Which of the following statements is false

Q39: Which of these numbered features contains the

Q66: On January 1, Barton Co. purchased land

Q69: Which sequence of events is required to

Q71: For what reasons might a company purchase

Q79: A pension is<br>A) a cost such as