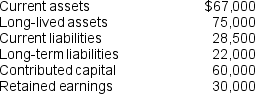

Gomer Paper Corporation has the following balance sheet accounts immediately preceding an investing and financing decision:

A long-term debt covenant specifies that Gomer Paper's debt/equity ratio cannot be greater than 1.0 and its current ratio must be at least 2.0.

A long-term debt covenant specifies that Gomer Paper's debt/equity ratio cannot be greater than 1.0 and its current ratio must be at least 2.0.

Gomer Paper is going to invest $70,000 in new equipment. It is considering two methods of financing the investment. It can use $10,000 of its own money and obtain $60,000 from the issue of long-term debt. Alternatively, Gomer Paper can use $15,000 of its own money and obtain the remaining financing from the issue of stock.

A. Recalculate the balance sheet amounts given above for each of the two financing alternatives immediately after financing is achieved and the investment is undertaken.

B. Use numerical calculations to determine if the debt covenants are respected under each of the two financing alternatives. If the covenants are broken for each alternative, suggest financing options that Gomer Paper might use to finance the $70,000 investment in equipment.

Definitions:

Q1: Is consistency violated when a company changes

Q5: How do items at the top of

Q7: For each transaction numbered 1 through 5

Q24: On December 31, 2009, Roper Company had

Q25: Which one of the following would increase

Q27: Which one of the following is needed

Q42: Duncan Industries sold $100,000 of 12 percent

Q56: The consolidation procedure of accounting for long-term

Q59: Which one of the following events is

Q108: Camber Corp. owns 10% of Nova Corp's