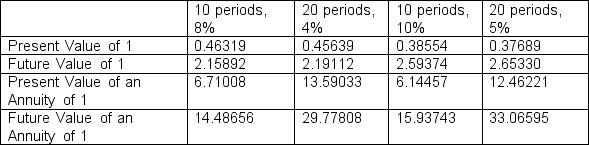

Stevens Company is about to issue $400,000 of 10-year bonds paying an 8% interest rate with interest payable semiannually. The effective interest rate for such securities is 10%. Below are available time value of money factors that Stevens chooses from to calculate compounded interest.

To the closest dollar, how much can Stevens expect to receive for the sale of these bonds?

To the closest dollar, how much can Stevens expect to receive for the sale of these bonds?

a. $350,151

b. $292,637

c. $800,000

d. $1,405,503

Definitions:

Triglyceride Levels

A measure of the amount of triglycerides, a type of fat, in the blood, which is an indicator of metabolic health.

SPSS Output

SPSS output refers to the results generated by the Statistical Package for the Social Sciences, a software used for statistical analysis.

Intense Exercise

Physical activity that requires a high level of effort, causing the heart rate to increase significantly and often aimed at improving physical fitness quickly.

Wilcoxon Signed Rank Test

A non-parametric statistical test used to compare two paired groups to find out if their population mean ranks differ.

Q18: Determine the cost of the equipment purchased

Q27: Which one of the following is needed

Q28: Beginning and ending balances for relevant balance

Q58: Tropical Corporation has the following amounts as

Q71: Limestone is primarily composed of:<br>A) calcium carbonate<br>B)

Q76: On January 1, 2010, Jackson Corporation issued

Q96: Which of the following is a correctly

Q97: The following information related to the marketable

Q98: Using the diagram below, if you were

Q104: Magnolia Products has a trading security investment