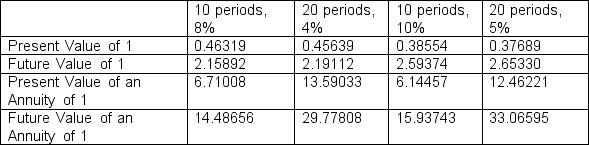

Stevens Company is about to issue $400,000 of 10-year bonds paying an 8% interest rate with interest payable semiannually. The effective interest rate for such securities is 10%. Below are available time value of money factors that Stevens chooses from to calculate compounded interest.

To the closest dollar, how much can Stevens expect to receive for the sale of these bonds?

To the closest dollar, how much can Stevens expect to receive for the sale of these bonds?

a. $350,151

b. $292,637

c. $800,000

d. $1,405,503

Definitions:

First Development

The initial phase of growth or advancement in an area, organization, or system, marking the beginning of significant progress or change.

Process Innovation

The improvement or development of new methods in the production process, enhancing efficiency or productivity.

Total Product Curve

A graphical representation showing how total output of a firm varies with a change in a single input while holding other inputs constant.

Average Total Cost Curve

A graphical representation showing the average cost per unit of output at different levels of production.

Q3: During the 1990's, Golden Inc. entered into

Q4: Which of the following generally is true

Q25: The management of Dayton Ltd. erroneously understated

Q31: Which one of the following events decreases

Q38: Which one of the following actions will

Q49: Ruby uses the LIFO cost flow assumption.

Q68: Which of the following long-lived assets is

Q74: York Corporation owns 25% of Carson, Inc.

Q97: The following information related to the marketable

Q120: On January 1, 2009, Action Corporation issued