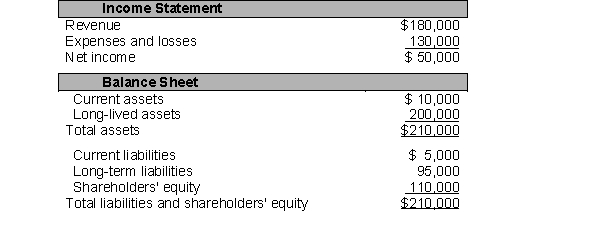

Howell Incorporated current income statement and December 31 balance sheet follow:  During an audit of Howell's current financial statements, its auditor discovered that Howell is a defendant in a $20,000 lawsuit for infringement of patent rights. Howell's management, under the advice of its legal counsel, decided that it was only reasonably probable that they would lose the suit and have to pay $20,000. However, its auditor disagreed with the treatment of the contingent loss and effectively argued that it is probable that the lawsuit will require Howell to pay $20,000 in the forthcoming year. The management of Howell decided to "take a bath" and treat the $20,000 lawsuit consistent with GAAP on probable conditional liabilities.

During an audit of Howell's current financial statements, its auditor discovered that Howell is a defendant in a $20,000 lawsuit for infringement of patent rights. Howell's management, under the advice of its legal counsel, decided that it was only reasonably probable that they would lose the suit and have to pay $20,000. However, its auditor disagreed with the treatment of the contingent loss and effectively argued that it is probable that the lawsuit will require Howell to pay $20,000 in the forthcoming year. The management of Howell decided to "take a bath" and treat the $20,000 lawsuit consistent with GAAP on probable conditional liabilities.

A. Reconstruct Howell current income statement and 12/31 balance sheet under the auditor's judgment concerning the $20,000 lawsuit

B. Calculate and compare current, debt/equity, and debt/asset ratios resulting from Howell's initial and reconstructed financial statements. Comment on Howell's solvency.

Definitions:

Unearned Revenue

Money received by an entity for a service or product that has yet to be provided or delivered.

Non-Interest-Bearing Note

A promissory note with no stated interest rate, implying that interest is either implied in the transaction price or nonexistent.

Interest Expense

The expenses a company faces for borrowing money, usually shown on the income statement.

Discount On Notes Payable

This refers to the difference between the face value of a note payable and the amount received by the issuer, representing extra cost to be amortized over the term of the note.

Q14: The recognition of a deferred tax liability

Q38: Selected information from Cooke Inc. is provided

Q44: Which of the following policies would increase

Q48: Short-term notes payable typically arise because<br>A) the

Q51: Kemp Clothing has cost of goods sold

Q53: Summers, Inc. uses the allowance method to

Q54: Which one of the following should be

Q62: On January 1, a company purchased land

Q72: Comprehensive income<br>A) may be reported on a

Q87: Which one of the following is added