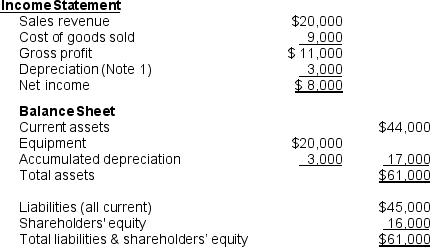

Mondova Corporation began operations on January 1. Below is Mondova's current net income statement and December 31 balance sheet calculated using straight-line depreciation.

Note 1: Equipment was purchased on January 1. Straight-line depreciation method was used with an estimated economic life of 5 years.

Note 1: Equipment was purchased on January 1. Straight-line depreciation method was used with an estimated economic life of 5 years.

A. Determine the estimated salvage value of the equipment being depreciated using the straight-line method.

B. Prepare an income statement and balance sheet in the same format as presented above assuming that Mondova Corporation uses the double-declining-balance depreciation method. The equipment has an estimated economic life of 5 years.

C. Calculate and compare Mondova's December 31 current ratio, debt/equity ratio, and debt to assets ratio using the financial statements constructed using the straight-line and double-declining-balance methods of depreciation.

Definitions:

Temperament

Temperament is a person's or animal's nature, especially as it permanently affects their behavior, involving aspects of their personality and emotional responses.

Secure Attachment

A stable and positive emotional bond between an infant and their caregiver, characterized by comfort and confidence in accessibility and responsiveness.

Imprinting

A form of learning occurring at a particular life stage that is rapid and apparently independent of the consequences of behavior, leading to a long-lasting behavioral response to a specific individual or object.

Parental Nurture

The care, love, and support that parents provide to their offspring, significantly impacting their emotional and physical development.

Q2: On January 1, 2009, Standard Incorporated is

Q14: Which of the following ratios might a

Q21: Sunrise Designs maintains a credit line with

Q31: Hubbell Service showed the following information for

Q37: On January 1, 2010, Simpson Company purchased

Q48: Many ratios require an average be used

Q55: Equity investments are:<br>A) investments in bonds of

Q71: For what reasons might a company purchase

Q85: Determine the coupon rate of interest on

Q116: Distinguish between an installment obligation and a