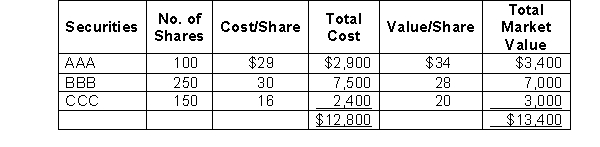

The following information related to the marketable security investments of Solo Company. Securities held on December 31, 2009, as described in the table below. AAA and BBB are classified as trading securities and CCC is classified as an available-for-sale security.  Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB, and dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market values of BBB and CCC on December 31, 2010, were $24 and $18, respectively. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share and the 150 shares of CCC for $22 per share. The journal entry to record the revaluation of BBB shares in 2010 is:

Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB, and dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market values of BBB and CCC on December 31, 2010, were $24 and $18, respectively. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share and the 150 shares of CCC for $22 per share. The journal entry to record the revaluation of BBB shares in 2010 is:

Definitions:

Opinion Leader

An individual who has the ability to influence the opinions, beliefs, or behaviors of others due to their authority, knowledge, position, or relationship.

Pew Research Center

A nonpartisan fact tank that conducts public opinion polling, demographic research, and content analysis to inform the public about issues, attitudes, and trends shaping the world.

Newspaper Industry

The Newspaper Industry comprises companies and entities that publish newspapers, which are scheduled publications containing news, information, and advertising.

Digital Newspapers

Newspapers that are published and read in digital format, often accessible through the Internet.

Q17: Immediately before a 3-for-1 stock split was

Q19: Calculate Campbell's return on equity and return

Q38: Paxton's aging schedule of its accounts receivable

Q53: The following information from St. Paul Supply,

Q76: What effect will the acquisition of treasury

Q86: Which of the following changes describes the

Q90: Which of the following is considered to

Q91: Crosson Company uses the straight-line method of

Q95: If an interest-bearing note payable is issued

Q127: Determine total liabilities for Sheena, Inc. for