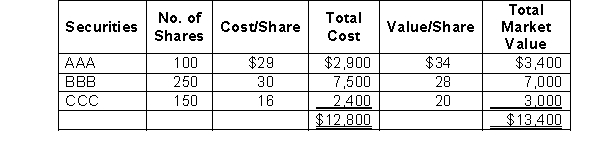

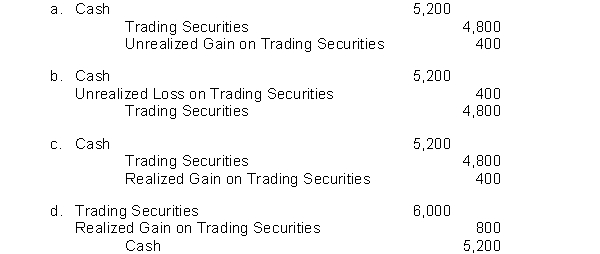

The following information related to the marketable security investments of Solo Company. Securities held on December 31, 2009, as described in the table below. AAA and BBB are classified as trading securities and CCC is classified as an available-for-sale security.  Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB. The per-share market value of BBB on December 31, 2010, was $24. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share. The journal entry to record the sale of 200 shares of BBB stock in 2011 is:

Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB. The per-share market value of BBB on December 31, 2010, was $24. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share. The journal entry to record the sale of 200 shares of BBB stock in 2011 is:

Definitions:

Owner's Equity Statement

A financial document that details changes in the equity of a business's owner(s) over a period of time.

Income Statement

A financial document that shows a company's revenues and expenses over a specific period, culminating in the net income.

Balance Sheet

A financial statement that provides a snapshot of a company's financial position at a particular date, reporting assets, liabilities, and equity.

Total Assets

The sum of all resources owned by a company, valued in monetary terms.

Q19: Julia Used Cars offers a one-year warranty

Q56: When companies construct their own long-lived assets,

Q60: How does operating performance differ from financial

Q63: Why might a company redeem bonds before

Q73: Investments in equity securities are current assets

Q78: How does the concept of 'merger' differ

Q91: On December 1, 2009, Fox Corporation purchased

Q101: On December 31, 2010, immediately after all

Q105: Calculate Laney's depreciation expense and loss (gain)

Q116: Distinguish between an installment obligation and a