Matching Questions

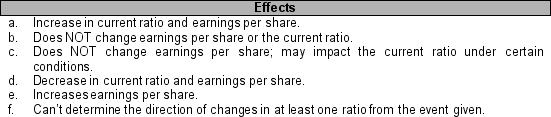

-Each transaction numbered 1 through 5 below involves an equity security originally acquired at a cost of $1,000. Identify the effect each transaction has on the current ratio and earnings per share by selecting from the effects listed in a through f. You may use each letter more than once or not at all.

____ 1. Trading securities with a current balance sheet value of $1,200 are sold for $1,100.

____ 2. Trading securities with a current balance sheet value of $800 are sold for $800.

____ 3. Trading securities with a current balance sheet value of $1,200 are sold for $1,300.

____ 4. Available-for-sale securities have a market value of $800 at yearend.

____ 5. Available-for-sale securities have a market value of $1,200 at yearend.

Definitions:

Q21: If preferred stock, which can be exchanged

Q28: On January 1, 2009, Justin Corp. leased

Q29: Jake Company borrowed $100,000 from Guaranty Trust

Q48: Dividends payable is recorded at the date

Q55: On January 1, 2010, Gee Company issued

Q78: A multinational is<br>A) a company that prepares

Q91: The industry in which Carter is a

Q91: An asset account<br>A) has a debit balance.<br>B)

Q100: Forrest's Crab House purchased Florida stone crab

Q106: Phoenix Corp. paid rent of $12,000 per