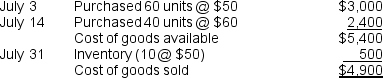

Yogi Company began operations on July 1. Below is its July income statement and the current portion of its balance sheet dated July 31. Each unit is sold for $80. Under the LIFO method of inventory, Yogi reported the following:

Complete the following income statement and current portion of the balance sheet for Yogi for July using the FIFO cost flow assumption instead of LIFO.

Complete the following income statement and current portion of the balance sheet for Yogi for July using the FIFO cost flow assumption instead of LIFO.

Sales revenue . . . . . . . . . . . . . . . . . _____________________

Cost of goods sold . . . . . . . . . . . . . ._____________________

Gross profit . . . . . . . . . . . . . . . . . . . _____________________

Definitions:

Benefit

An advantage or profit gained from something.

Foregone Benefit

The lost potential gain from other alternatives when one alternative is chosen.

Alternative Cost

Also known as opportunity cost, it represents the benefit that is missed or given up when choosing one alternative over another.

Comparative Cost

Analyzing and comparing the costs of different business strategies or production methodologies to identify the most effective option.

Q1: Three years ago, Astro Masters, Inc. purchased

Q2: Under generally accepted accounting principles, a company

Q15: How would the current ratio be affected

Q16: One of Tonic Corp's employees invented a

Q43: What is depreciation?

Q60: Which of the following statements about Special

Q63: Which one of the following groups of

Q85: When making adjustments to plant asset accounts,<br>A)

Q96: During an extended period of constant prices,

Q101: The process of expensing the cost of