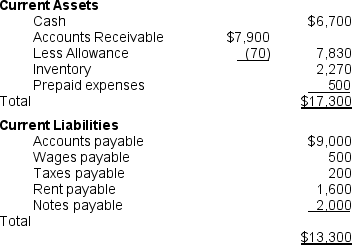

The following information concerning the current assets and current liabilities of

Mason Company at December 31, 2010, is presented below.

Based on this information, how would the current ratio be affected if Mason collects the accounts receivable and then uses some of the cash to pay off the accounts payable?

Based on this information, how would the current ratio be affected if Mason collects the accounts receivable and then uses some of the cash to pay off the accounts payable?

a. The current ratio would increase from 1.30 to 1.93.

b. The current ratio would increase from 0.74 to 4.02.

c. The current ratio would decrease from 1.30 to 0.62.

d. The current ratio would increase from 1.09 to 1.61.

Definitions:

German Piano Manufacturer

A company based in Germany specializing in the creation and production of pianos.

Joint Venture

A business arrangement where two or more parties agree to pool their resources for the purpose of accomplishing a specific task or business activity.

Repatriation

The process of returning a person to their country of origin or citizenship, often used in the context of employees returning home after international assignments.

Foreign Assignments

Work tasks or roles allocated to employees in a location outside of their home country, typically as part of international business operations.

Q2: Calculate Campbell's current and quick ratios as

Q15: A company that reports high levels of

Q36: If the industry in which Carter is

Q36: The following information related to the marketable

Q44: Which of the following policies would increase

Q53: During a period of rising prices and

Q62: Polo, Inc. uses the direct write-off method

Q79: A pension is<br>A) a cost such as

Q117: The Favre Company made the following expenditures

Q124: Journal entries are used to indicate how<br>A)