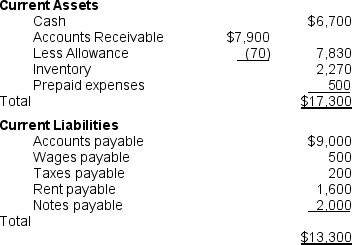

The following information concerning the current assets and current liabilities of

Mason Company at December 31, 2010, is presented below.

Based on this information, how would the quick ratio be affected if Mason purchased $1,300 of inventory on account?

Based on this information, how would the quick ratio be affected if Mason purchased $1,300 of inventory on account?

a. The quick ratio would decrease from 1.30 to 1.21.

b. The quick ratio would not change.

c. The quick ratio would decrease from 1.09 to 1.00.

d. The quick ratio would decrease from 1.09 to 1.21.

Definitions:

Securities Act

A U.S. federal law enacted in 1933 that governs the first sale of securities (stocks, bonds) to the public, requiring disclosure and registration.

Public Securities

Public Securities are financial instruments issued by governments or municipalities, such as bonds or notes, that are available for purchase by the public.

United Delivery

A generic term possibly referring to a delivery or courier service that operates on a uniform or nationwide basis.

Corporate Outsiders

Individuals or entities that are not directly involved in the internal management or operations of a corporation, such as investors or the general public.

Q7: Tyson Corp. uses the aging method to

Q38: Paxton's aging schedule of its accounts receivable

Q40: What business aspect does the statement of

Q41: Why are market values not used for

Q53: Liabilities are $2,000, retained earnings are $1,000,

Q59: Inventory on January 1 and December 31

Q94: The following are partial balance sheets for

Q95: Portland Supplies Co. mistakenly excluded $3,000 of

Q95: Operating performance is a company's ability to<br>A)

Q109: Once a company establishes that an estimated