The following information was taken from the unadjusted trial balance and aging schedule of Diane Company on December 31, 2010. All sales are on account.

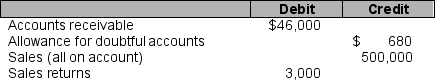

Accounts and related balances at December 31, 2010 before adjustment:

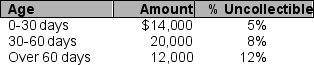

Aging Schedule of Accounts Receivable:

Aging Schedule of Accounts Receivable:

If Diane uses the aging schedule of accounts receivable to determine bad debts, what is the bad debts expense for the year ending December 31, 2010?

If Diane uses the aging schedule of accounts receivable to determine bad debts, what is the bad debts expense for the year ending December 31, 2010?

a. $4,280

b. $3,600

c. $3,680

d. $3,060

Definitions:

Times Interest Earned Ratio

A financial metric that measures a company's ability to meet its debt obligations by comparing its income before interest and taxes (EBIT) to its interest expenses.

Bonds Payable

represent long-term debt securities issued by corporations or governments, obligating the issuer to pay the bondholder the principal plus interest.

Interest Expense

The cost incurred by an entity for borrowed funds over a period, reflecting the interest payments on its debt.

Issuing Bonds

The process by which a corporation or government raises funds by selling debt securities to investors.

Q8: If an entity overstates its ending inventory

Q23: Failure to record depreciation expense during a

Q30: The allowance for doubtful accounts is<br>A) an

Q44: Intangible assets are:<br>A) goodwill, patents, copyrights, and

Q55: During a period of rising prices and

Q56: Total assets, liabilities, and shareholders' equity are

Q79: How is the purchase method used in

Q85: Accounting numbers are useful in that they<br>A)

Q98: The retained earnings section of the statement

Q119: Inventory on January 1 and December 31