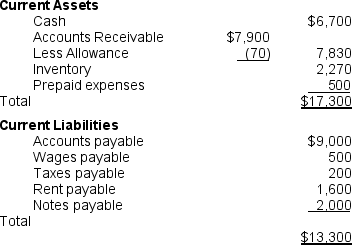

The following information concerning the current assets and current liabilities of

Mason Company at December 31, 2010, is presented below.

Based on this information, what would the quick ratio be if Mason sold all of its inventory for $6,000 cash?

Based on this information, what would the quick ratio be if Mason sold all of its inventory for $6,000 cash?

a. The quick ratio would decrease from 1.09 to 0.19.

b. The quick ratio would decrease from 1.30 to 0.85.

c. The quick ratio would increase from 1.30 to 1.54.

d. The quick ratio would increase from 1.09 to 1.54.

Definitions:

Market Shares

The percentage of an industry's sales that is earned by a particular company over a certain time period.

Monopolistically Competitive

Characterizing a market environment where several sellers offer differentiated products, resulting in non-price competitive strategies.

Price-Taker

An economic agent (e.g., a firm or consumer) that has no control over the market price and must accept prices as given.

Economic Profit

The surplus achieved when total revenue exceeds the opportunity costs of all resources used in production.

Q21: The matching principle states that:<br>A) expenses should

Q24: On December 1, 2010, Karr Company purchased

Q35: The balance in accumulated depreciation on January

Q39: If the industry in which Carter is

Q39: For each financial statement item listed in

Q47: Match the descriptions listed in letters a

Q52: Favre Company has current assets, shareholders' equity,

Q65: The principle of consistency states that:<br>A) companies

Q85: Kristin, Inc. depreciates its plant assets over

Q113: Describe a debit. How does it impact