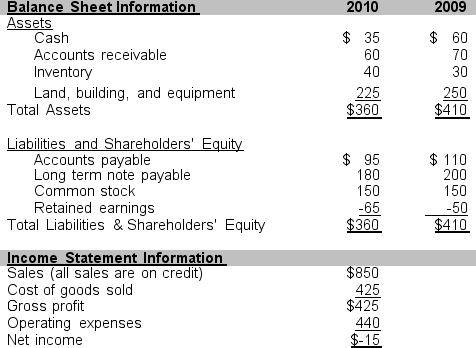

Use the information that follows taken from Campbell Company's financial statements for the years ending December 31, 2010 and 2009 to answer problems 45 through 48.

-Calculate Campbell's return on equity and return on assets for the year ended December 31, 2010. Assume that the income tax rate is 30%. Also assume that in Campbell's industry, the industry average return on equity is 19% and the average return on assets is 11%.

Definitions:

Financing Activities

Transactions that result in changes in the size and composition of the equity capital or borrowings of the entity, as reported in a company’s cash flow statement.

Non-current Liability

Liabilities that are not due within the next twelve months, such as long-term loans, bonds payable, and deferred tax liabilities.

Short-term Loans

Loans scheduled to be repaid in less than a year, typically used for immediate cash flow needs or small-scale expenses.

Cash Flows

Cash flows refer to the inflows and outflows of cash and cash equivalents, representing the operating, investing, and financing activities of an entity during a specific period.

Q2: Under generally accepted accounting principles, a company

Q6: Which one of the following is most

Q33: What financial statement shows where the money

Q45: Briefly describe the solvency and profitability of

Q49: Calculate Monroe's depreciation expense and loss (gain)

Q58: Inventory reported on the balance sheet of

Q61: The information below was taken from the

Q70: For each cost numbered 1 through 8

Q80: The most common point of revenue recognition

Q100: On January 27, 2010, Lock Company entered