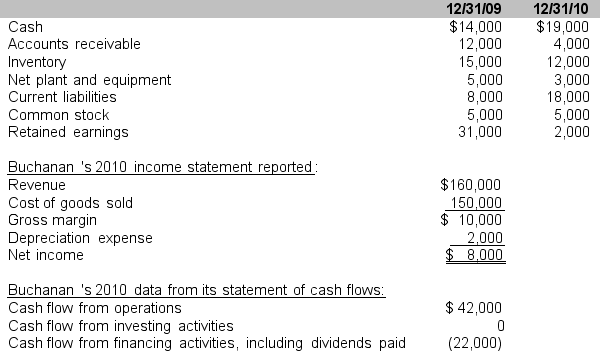

Buchanan Company has the following financial data on December 31, 2010 and 2009:

Required: Using appropriate ratios, comment on the change in Buchanan's solvency position and assess the probable cause of the change from 2009 to 2010.

Required: Using appropriate ratios, comment on the change in Buchanan's solvency position and assess the probable cause of the change from 2009 to 2010.

Definitions:

Overhead Rate

A calculation used to allocate indirect costs to produced goods, based on a specific base, such as labor hours.

Direct Labor Cost

The total cost of employment for employees who directly contribute to the production of goods or services, including wages and benefits.

Machine-Hours

A measure of the total time that machines are operating in a manufacturing process.

Predetermined Overhead Rate

The predetermined overhead rate is calculated by dividing estimated overhead costs by an allocation base, such as direct labor hours, to allocate overhead costs to products or services.

Q28: Given below is a listing of selected

Q29: Can a company use the direct write-off

Q40: Intangible assets differ from plant assets in

Q47: Which of the following ratios would be

Q47: For each financial statement item listed in

Q48: Many ratios require an average be used

Q70: For each cost numbered 1 through 8

Q91: What is the name of a person

Q106: During a period of rising prices and

Q119: Inventory on January 1 and December 31