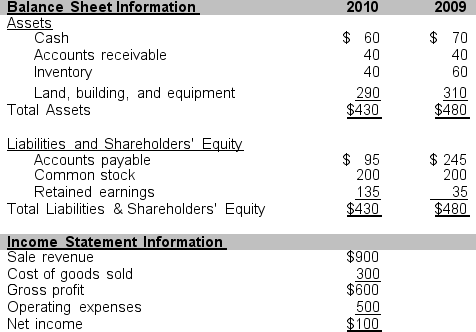

Use the information that follows taken from Carter Company's financial statements for the years ending December 31, 2010 and 2009 to answer problems 3 through 9.

-Washington Company has current assets, current liabilities, and long-term liabilities of $8,000, $2,000, and $5,000, respectively at the end of 2010. How much cash can Washington use to acquire equipment and retain a current ratio of at least 2.0?

Definitions:

Barriers To Entry

Economic, procedural, or regulatory obstacles that prevent new competitors from easily entering an industry or area of business.

Oligopolistic

Pertaining to a market structure where a small number of firms dominate the industry, influencing prices and marketing strategies.

Perfectly Competitive

A market structure characterized by a complete absence of rivalry among the sellers and an infinite number of buyers and sellers, where no single buyer or seller has market power.

Identical Products

Goods that are exactly the same in every feature, quality, and specification, allowing no variation between them.

Q9: Pasky Company has the following financial data

Q22: Identify the role of the matching principle

Q38: Rudy Company has total assets, liabilities, and

Q46: How much is the book value of

Q46: Which financial statement would you review to

Q49: What methods of controlling the ethical decisions

Q57: If Behrend uses the aging schedule of

Q80: The current ratio<br>A) provides users with an

Q91: On December 1, 2009, Fox Corporation purchased

Q130: When an adjusting entry that recognizes accrued