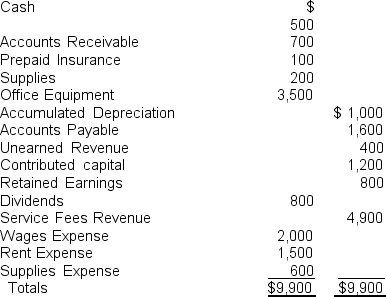

Use the information that follows taken from the unadjusted accounting records of Sheena, Inc. for the year ending December 31, 2010 to answer problems 24 through 26.

The following information is needed for adjusting entries at the end of December.

The following information is needed for adjusting entries at the end of December.

a. On December 31, 2010, the insurance expired amounted to $80.

b. Of the unearned revenue, $250 of services had been performed.

c. Services have been performed for customers that have not yet been billed or paid totaling $180.

d. The office equipment computation for 2010 depreciation amounts to $200.

-What is the effect on net income of each of the adjusting entries necessary for Sheena, Inc.?

Definitions:

Owner's Capital Account

An account on a company's balance sheet representing the total investment made by the owner(s), minus any withdrawals.

Financial Statements

Comprehensive reports that provide an overview of a company's financial condition, including balance sheets, income statements, and cash flow statements.

Total Debits

The sum of all debit entries recorded in the accounting ledger, reflecting assets or expenses that have increased.

Total Credits

The sum of all credit entries recorded in a financial account, representing increases in assets or decreases in liabilities.

Q15: The amount a company expects to collect

Q36: If the industry in which Carter is

Q51: Why would a company recognize the cost

Q63: The balance sheet reported supplies of $1,900

Q71: The cost of perpetual preferred stock is

Q84: Most investors believe that the statement of

Q85: Which assets on a company's balance sheet

Q90: If the balance sheet is in balance,<br>A)

Q94: Which one of the following companies would

Q104: If accounts receivable on January 1 totals