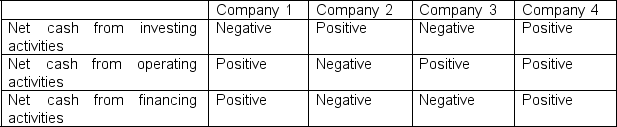

The following chart presents the cash flow profiles of four companies. All four companies are in the same industry and are comparable in size. Based on this limited information, which company likely has the weakest quality of earnings?

Definitions:

Beta

A measure of the volatility, or systematic risk, of a security or a portfolio compared to the market as a whole.

Dividend

A portion of a company's earnings that is distributed to shareholders, usually on a regular basis.

Beta

A standard for evaluating how the systematic risk or volatility of a security or portfolio stands in relation to the entire market.

Portfolio

A collection of financial assets such as stocks, bonds, commodities, currencies, and cash equivalents, as well as their fund counterparts.

Q5: The strike price is the price that

Q16: Which of the following statements is CORRECT?<br>A)

Q26: Which one of the following groups of

Q39: Why do managers need to understand how

Q39: Three years ago, Astro Masters, Inc. purchased

Q52: Why must managers understand financial reporting?

Q61: The cost of debt is equal to

Q64: When adding a randomly chosen new stock

Q99: Annual reports of public companies<br>A) are published

Q109: Total assets, liabilities, and shareholders' equity are