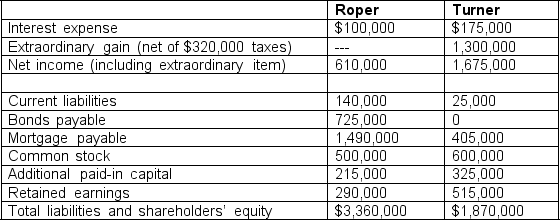

-The following selected financial information was obtained from the 2010 financial reports of Roper Designs and Turner Industries:

Required:

Required:

a. Assume that you are considering purchasing the common stock of one of these companies. (Since you have limited data, assume that the beginning balance sheet amounts equal ending balance sheet amounts for total assets and stockholders' equity.) Based on this information, which company has a higher return on equity? Would your conclusion be different if the impact of the extraordinary item had not been included in net income? Should the extraordinary item be considered? Why or why not?

b. Which company uses leverage more effectively? Does your answer change if you do not consider the impact of the extraordinary item on net income?

Definitions:

Japanese Invasion

Refers to various military incursions and expansions conducted by Japan, particularly during the first half of the 20th century, impacting several countries across Asia.

Lend-Lease Act

1941 law that permitted the United States to lend or lease arms and other supplies to the Allies, signifying increasing likelihood of American involvement in World War II.

Nonaggression Treaty

An agreement between two or more nations not to attack each other, often part of broader peace initiatives.

Military Aid

Assistance provided by one country to another in the form of defense equipment, training, or other support services for military purposes.

Q5: The strike price is the price that

Q14: Cash received by a company from its

Q18: On July 1, 2010, Erie Company rented

Q41: On July 1, 2009, Roseland Inc. purchased

Q65: A debt investor is<br>A) a person who

Q66: Given below are several accounts from Caterpillar

Q71: Houston Times Publishing Inc. sells two-year magazine

Q97: Total assets, liabilities, and shareholders' equity are

Q112: Choudhary Corp believes the following probability

Q127: Mike Flannery holds the following portfolio: <img