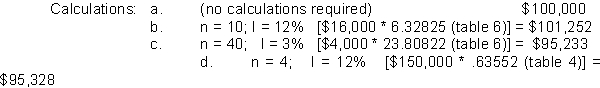

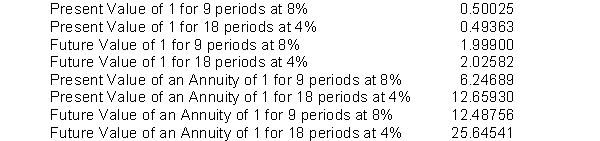

-Everett Corporation issues a 8%, 9-year mortgage note on January 1, 2009, to obtain financing for new equipment. Land is used as collateral for the note. The terms provide for semiannual installment payments of $131,600. The following values related to the time value of money were available to Everett to help them with their planning process and compounded interest decisions.  To the closest dollar, what were the cash proceeds received from the issuance of the note?

To the closest dollar, what were the cash proceeds received from the issuance of the note?

Definitions:

Federal Reserve Notes

The official currency issued by the Federal Reserve System, constituting the primary form of paper money in the United States.

Federal Reserve System

The chief banking authority in the United States, tasked with the formulation of monetary policy and the oversight of banking institutions.

Deposit Insurance

Deposit insurance is a financial safeguard that protects depositors’ money in the event of a bank failure, guaranteeing a certain amount of an individual's deposits in member banks.

Commercial Banks

Financial institutions offering a range of services, including deposit accounts, loans, and credit.

Q2: Xenon, a major defense contractor, was faced

Q31: Which of the following statements is true?<br>A)

Q51: For each statement listed in 1 through

Q55: Why is inflation ignored in accounting?

Q56: Bond A has a 9% annual coupon,

Q74: Dividends declared and paid to the owners

Q79: Your bank account pays an 8% nominal

Q83: Time lines can be constructed in situations

Q101: On December 31, 2010, immediately after all

Q129: Able Industries has the following information