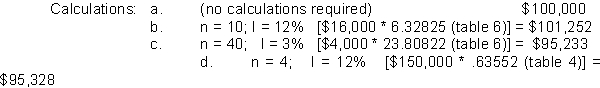

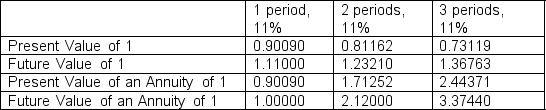

-Gaynor Company is considering purchasing equipment. The equipment will produce the following cash flows: Year 1, $25,000; Year 2, $45,000; Year 3, $60,000. Below is some of the time value of money information that Gaynor has compiled that might help them in their planning and compounded interest decisions.  Gaynor requires a minimum rate of return of 11%. To the closest dollar, what is the maximum price Gaynor should pay for the equipment?

Gaynor requires a minimum rate of return of 11%. To the closest dollar, what is the maximum price Gaynor should pay for the equipment?

Definitions:

Depletion

A method used to allocate the cost of extracting natural resources, such as timber, minerals, and oil, from the earth over the period those resources are consumed.

Reclamation

The process of restoring land that has been mined, logged, or used for industrial purposes back to its natural state or ensuring it is usable for a different purpose.

Accumulated Depreciation

The cumulative value of depreciation expense assigned to a physical asset from the time it was first utilized.

Major Class of Asset

Represents categories of assets grouped based on their similar financial characteristics, such as cash, inventory, property, etc.

Q4: Suppose you believe that Delva Corporation's stock

Q6: Which one of the following is most

Q8: Thomas Young invested $15,000 at 10% annual

Q11: You plan to invest in securities that

Q38: Shareholders<br>A) and employees are the owners of

Q40: Sonnan Company showed profits for the last

Q41: Which of the following statements is CORRECT?<br>A)

Q45: Why is present value not used more

Q80: Goodyear Co. purchased $2,000 of equipment with

Q127: Determine total liabilities for Sheena, Inc. for