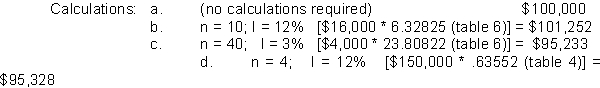

-Morgan is considering entering into a contract to sell a building on January 1 in exchange for a note. The note pays a lump sum payment of $300,000 in ten years and ten annual payments of $2,500 beginning on the date of sale (January 1) . If the annual interest rate is 10 percent, what is the total present value of the contract?

Definitions:

Regression Line

A statistical tool represented as a line on a graph that best fits the data points, showing the relationship between two variables.

Profits

The financial gain obtained when the revenues from business activities exceed the expenses, costs, and taxes associated with the operation.

Exponential Smoothing

A time series forecasting method for smoothing data points by assigning exponentially decreasing weights over time.

Trend Adjustment

A statistical technique used to correct or adjust data to account for systematic patterns or trends over time, improving the accuracy of forecasts.

Q6: If we are given a periodic interest

Q7: Sheena Company has accounts receivable of $13,000,

Q10: If the current price of a stock

Q43: The slope of the SML is determined

Q63: If the required rate of return on

Q71: Which Of The Following Statements Is CORRECT?<br>A)

Q82: For bonds, price sensitivity to a given

Q92: Which of the following statements best describes

Q111: On December 13, 2010, Tucson Corp. paid

Q130: When an adjusting entry that recognizes accrued