-Mitch has been offered three different contracts for a service he provides. Contract 1: $9,000 received at the beginning of each year for ten years, compounded at a 6 percent annual rate.

Contract 2: $9,000 received today and $20,000 received ten years from today. The relevant interest rate is 12 percent.

Contract 3: $9,000 received at the end of Years 4, 5, and 6. The relevant annual interest rate is 10 percent.

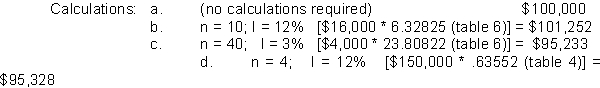

What is the present value of Contract 2?

Definitions:

Compound Interest

Interest that is determined by taking into account not only the original principal of a deposit or loan but also all the interest that has been compounded in previous cycles.

Earnings Rate

The return on an investment or the amount of profit made compared to the amount of money invested.

Internal Rate of Return

An investment’s projected rate of return, calculated by finding the discount rate that sets the net present value of all cash flows (both positive and negative) to zero.

Present Value

Present value is the current worth of a future sum of money or stream of cash flows, given a specified rate of return, adjusting for the time value of money.

Q11: You plan to invest in securities that

Q19: Interest receivable on January 1 and December

Q34: You need to calculate the present value

Q36: Which one of the following transactions will

Q42: You want to quit your job and

Q62: Which of the following statements is CORRECT?<br>A)

Q89: Which of the following statements is CORRECT?<br>A)

Q91: Equipment with an original cost of $23,000

Q114: Providing $4,000 of services to customers on

Q135: The greater the number of compounding periods