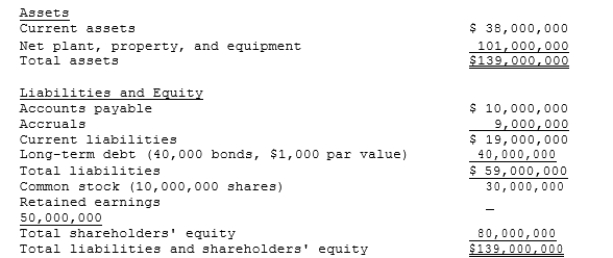

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable

The stock is currently selling for $15.25 per share, and its noncallable

$1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Which of the following is the best estimate for the weight of debt for

Use in calculating the firm's WACC?

Definitions:

Business Name

The official name under which a company or merchant conducts business, which may be different from its legal corporate name.

Ultra Vires Acts

Acts performed beyond the powers or authority granted to a corporation or an individual by law.

S Corporation

A special designation that allows corporations to pass income directly to shareholders and avoid double taxation.

Partnerships

A business structure where two or more individuals manage and operate a business in accordance with the terms and goals set out in a partnership agreement.

Q3: Suppose you just won the state lottery,

Q43: A statement that financial statement information "is

Q46: When estimating the cost of equity by

Q50: Ezzell Enterprises' noncallable bonds currently sell for

Q62: On which financial statement(s) would you find

Q64: The Morrissey Company's bonds mature in 7

Q65: Linke Motors has a beta of 1.30,

Q75: Which of the following statements is CORRECT?<br>A)

Q80: The reason why retained earnings have a

Q119: Stocks A, B, and C all have