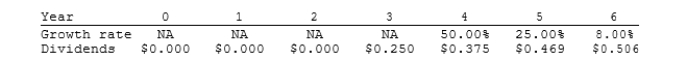

Agarwal Technologies was founded 10 years ago. It has been profitable for the last 5 years, but it has needed all of its earnings to support growth and thus has never paid a dividend. Management has indicated that it plans to pay a $0.25 dividend 3 years from today, then to increase it at a relatively rapid rate for 2 years, and then to increase it at a constant rate of 8.00% thereafter. Management's forecast of the future dividend stream, along with the forecasted growth rates, is shown below. Assuming a required return of 11.00%, what is your estimate of the stock's current value?

Definitions:

Q3: The required returns of Stocks X and

Q44: Intangible assets are:<br>A) goodwill, patents, copyrights, and

Q45: Information is considered material if:<br>A) it would

Q48: An investor is considering buying one of

Q63: What is the firm's market-to-book ratio?<br>A) 0.56<br>B)

Q64: When adding a randomly chosen new stock

Q64: Which of the following is <u>NOT</u> a

Q98: If you plotted the returns of a

Q99: Stock X has a beta of 0.5

Q105: All other things held constant, the present