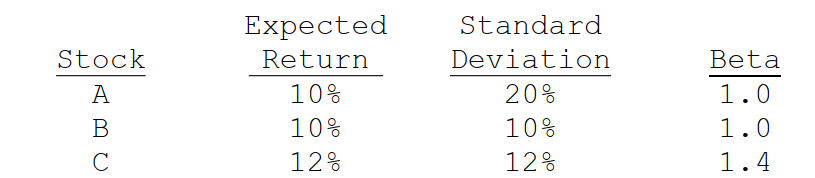

Consider the following information for three stocks, A, B, and C. The stocks' returns are positively but not perfectly positively correlated with one another, i.e., the correlations are all between 0 and 1.

Portfolio AB has half of its funds invested in Stock A and half in Stock B. Portfolio ABC has one third of its funds invested in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium, so required returns equal expected returns. Which of the following statements is CORRECT?

Definitions:

Group Behavior

The actions, norms, and psychological processes that occur within a social group or between social groups.

Experimental Study

A research method involving the manipulation of variables to test hypotheses and observe the effects on an outcome.

Cohesiveness

The degree to which members of a group are attracted to one another and motivated to stay in the group.

Randomly Assign

The process of allocating people or resources to groups or categories in a way that lacks any specific pattern, order, or objective.

Q3: If a company increases its safety stock,

Q6: How large are your monthly payments?<br>A) $6,250<br>B)

Q13: How much would you deposit today in

Q15: Which of the following would, generally, indicate

Q18: A 10-year bond pays an annual coupon,

Q56: Bond A has a 9% annual coupon,

Q63: What is the firm's market-to-book ratio?<br>A) 0.56<br>B)

Q63: Stock A has a beta of 0.8,

Q72: Last year Central Chemicals had sales of

Q134: Disregarding risk, if money has time value,