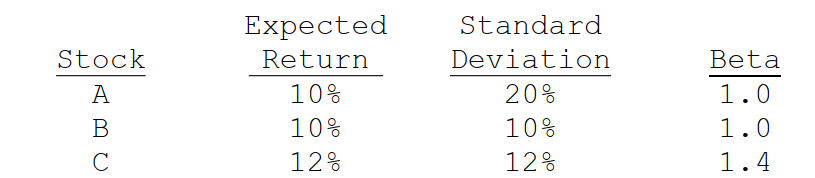

Consider the following information for three stocks, A, B, and C. The stocks' returns are positively but not perfectly positively correlated with one another, i.e., the correlations are all between 0 and 1.

Portfolio AB has half of its funds invested in Stock A and half in Stock B. Portfolio ABC has one third of its funds invested in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium, so required returns equal expected returns. Which of the following statements is CORRECT?

Definitions:

Biological Perspective

An approach in psychology focusing on the influence of genetics and physiological processes on behavior and mental states.

Systems Perspective

An approach to problem-solving and decision-making that considers the entire system, including all interacting components, rather than focusing on parts in isolation.

Service Orientation

A commitment to providing excellent service to customers or clients, often characterized by actively seeking ways to help and satisfy their needs.

Holding Environment

A supportive space that allows individuals to manage and process change or stress, often facilitated by leaders.

Q4: The net income amounts for Box and

Q5: What's the rate of return you would

Q18: The exercise value is the positive difference

Q28: The information below was taken from the

Q34: Stocks A and B each have an

Q43: Last year Rosenberg Corp. had $195,000 of

Q51: For each statement listed in 1 through

Q60: Public stock exchanges<br>A) are operated by managers

Q61: The cost of debt is equal to

Q68: What is the account, Accounts Payable, used