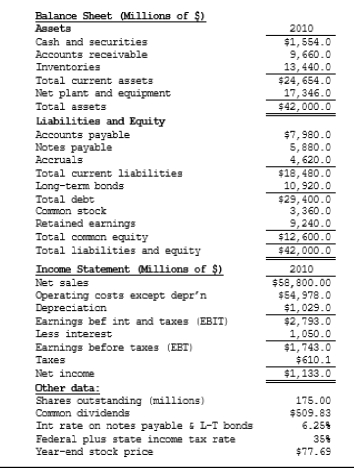

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-What is the firm's ROE?

Definitions:

Optimal Risky Portfolio

A portfolio composition that offers the highest expected return for a given level of risk or the lowest risk for a given level of expected return.

Risk-Free Rate

The rate of return on an investment with zero risk, typically represented by government bonds.

Expected Return

The average return an investor anticipates receiving from an investment, taking into account all possible outcomes.

Risk-Free Rate

The expected yield from an investment that is considered free from the risk of financial loss, often exemplified by the returns on government bonds.

Q6: Which of the following is true of

Q13: Heaton Corp. sells on terms that allow

Q14: Suppose the December CBOT Treasury bond futures

Q30: If a petrochemical firm that used oil

Q44: Which of the following statements is CORRECT?<br>A)

Q54: Stock A's beta is 1.5 and Stock

Q58: You are considering two equally risky annuities,

Q81: Preston Inc.'s stock has a 25% chance

Q90: You have funds that you want to

Q94: Income bonds pay interest only if the