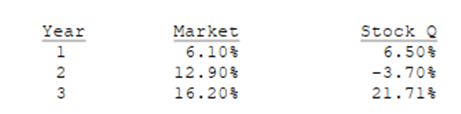

You are given the following returns on "the market" and Stock Q during the last three years. We could calculate beta using data for Years 1 and 2 and then, after Year 3, calculate a new beta for Years 2 and 3. How different are those two betas, i.e., what's the value of beta 2 - beta 1? (Hint: You can find betas using the Rise-Over-Run method, or using your calculator's regression function.)

Definitions:

Right Atrium

The right atrium is one of the four chambers of the heart, receiving deoxygenated blood from the body and passing it to the right ventricle.

Force Exerted

The physical pressure or effort applied to something.

Precapillary Sphincters

Circular muscles located at the entrance of capillaries that regulate blood flow into the capillary beds.

Capillaries

Microscopic blood vessels that facilitate the exchange of water, oxygen, carbon dioxide, and many other nutrients and waste substances between blood and tissues.

Q6: How large are your monthly payments?<br>A) $6,250<br>B)

Q12: The present value of a future sum

Q14: Unlike bonds, the cost of preferred stock

Q16: Leak Inc. forecasts the free cash flows

Q22: The capital intensity ratio is the amount

Q30: Which of the following assumptions is embodied

Q33: Suppose firms follow similar financing policies, face

Q61: Vang Corp.'s stock price at the end

Q99: At a rate of 6.5%, what is

Q114: Suppose you have $2,000 and plan to