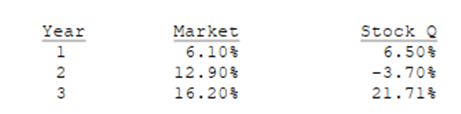

You are given the following returns on "the market" and Stock Q during the last three years. We could calculate beta using data for Years 1 and 2 and then, after Year 3, calculate a new beta for Years 2 and 3. How different are those two betas, i.e., what's the value of beta 2 - beta 1? (Hint: You can find betas using the Rise-Over-Run method, or using your calculator's regression function.)

Definitions:

Informal Techniques

Unofficial or non-traditional methods and approaches used in various fields or practices.

Simple Messages

Communications or statements that are easy to understand due to their clarity and lack of complexity.

Emotional Charged

Refers to communication or content that is loaded with emotions, intended to provoke an emotional response from the audience.

Instructor Workload

The amount of work and responsibilities assigned to a teacher or educator within an educational institution.

Q4: A just-in-time system is designed to stretch

Q7: A conglomerate merger occurs when two firms

Q15: The longer its customers normally hold inventory,

Q27: A company seeking to fight off a

Q48: Which of the following is <u>NOT</u> a

Q54: The firm's target capital structure should be

Q74: A promissory note is the document signed

Q103: High current and quick ratios always indicate

Q109: Because money has time value, a cash

Q128: Which of the following statements regarding a