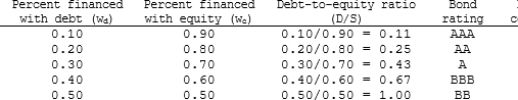

Aaron Athletics is trying to determine its optimal capital structure. The company's capital structure consists of debt and common stock. In order to estimate the cost of debt, the company has produced the

Following table:

The company uses the CAPM to estimate its cost of common equity, rs.

The risk-free rate is 5% and the market risk premium is 6%. Aaron estimates that if it had no debt its beta would be 1.0. (Its "unlevered beta," bU, equals 1.0.) The company's tax rate, T, is 40%.

On the basis of this information, what is the company's optimal capital structure, and what is the firm's cost of capital at this optimal

Capital structure?

Definitions:

Law of Diminishing Marginal Utility

states that as a person consumes more of a good or service, the utility (satisfaction) gained from each additional unit decreases.

Principal-agent Problem

A dilemma occurring when one person or entity (the agent), is able to make decisions on behalf of, or that impact, another person or entity: the principal.

Complementary Resource

A good or service that enhances the use or value of another good or service when the two are used together.

Productivity

A measure of the efficiency of production, often expressed as the ratio of outputs to inputs in a given timeframe.

Q2: If a profitable firm finds that it

Q2: The distribution of synergistic gains between the

Q8: A firm's AFN must come from external

Q16: <span class="ql-formula" data-value="\frac { d y }

Q17: An increase in the debt ratio will

Q18: Going public establishes a market value for

Q19: When deciding whether to offer a discount

Q22: In the MM extension with growth, the

Q91: Accruals are "free" capital in the sense

Q138: <span class="ql-formula" data-value="\int x ^ { 3