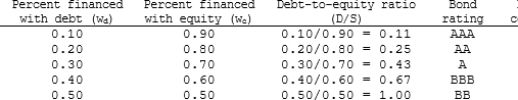

Aaron Athletics is trying to determine its optimal capital structure. The company's capital structure consists of debt and common stock. In order to estimate the cost of debt, the company has produced the

Following table:

The company uses the CAPM to estimate its cost of common equity, rs.

The risk-free rate is 5% and the market risk premium is 6%. Aaron estimates that if it had no debt its beta would be 1.0. (Its "unlevered beta," bU, equals 1.0.) The company's tax rate, T, is 40%.

On the basis of this information, what is the company's optimal capital structure, and what is the firm's cost of capital at this optimal

Capital structure?

Definitions:

Q1: When a firm refunds a debt issue,

Q8: According to the MM extension with growth,

Q9: Operating leases help to shift the risk

Q17: What is the Return on Invested Capital

Q20: A stock with a beta equal to

Q22: Which of the following statements is CORRECT?

Q44: The cash conversion cycle (CCC) combines three

Q46: A catamaran is running along a

Q84: Trade credit can be separated into two

Q122: <span class="ql-formula" data-value="\int _ { 0 }