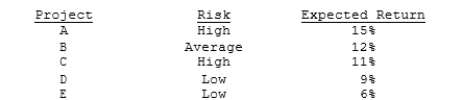

Langston Labs has an overall (composite) WACC of 10%, which reflects the cost of capital for its average asset. Its assets vary widely in risk, and Langston evaluates low-risk projects with a WACC of 8%, average-risk projects at 10%, and high-risk projects at 12%. The company is considering the following projects:  Which set of projects would maximize shareholder wealth?

Which set of projects would maximize shareholder wealth?

Definitions:

Internal Locus

pertains to the belief that one's actions are the result of personal choices and efforts.

Plain Unlucky

An expression describing a situation or outcome that is unfavorable and occurred by chance, without any specific cause.

Poor Grades

Reflects academic performance that falls below the expected or desired standard, often an indicator of difficulties in understanding or engaging with material.

Attitudes

Settled ways of thinking or feeling about something, often reflected in a person's behavior.

Q12: Assuming that their NPVs based on the

Q15: Which of the following statements is CORRECT?<br>A)

Q31: The term "additional funds needed (AFN)" is

Q31: A firm buys on terms of 3/15,

Q41: Borrowing funds on terms that would require

Q55: The rate of water usage for

Q58: One advantage of the payback method for

Q88: Which of the following statements is CORRECT?<br>A)

Q248: <span class="ql-formula" data-value="\int ( \ln 2 x

Q441: <span class="ql-formula" data-value="\int \cos ^ { 7