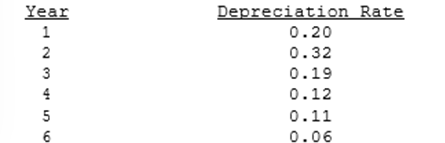

Marshall-Miller & Company is considering the purchase of a new machine for $50,000, installed. The machine has a tax life of 5 years, and it can be depreciated according to the following rates. The firm expects to operate the machine for 4 years and then to sell it for $12,500. If the marginal tax rate is 40%, what will the after-tax salvage value be when the machine is sold at the end of Year 4?

Definitions:

Liability

The condition of having legal accountability, especially regarding debts or legal duties.

Control

The power to direct the management and policies of a company or organization, often through ownership of a majority of shares.

Expansion

Expansion refers to the process of growing or enlarging the scale, scope, or reach of something, such as a business, territory, or concept.

Q1: <span class="ql-formula" data-value="\int \frac { \sqrt {

Q15: Find the area of the region

Q16: Financial Accounting Standards Board (FASB) Statement #13

Q24: Which of the following statements is CORRECT?<br>A)

Q45: Which of the following statements is CORRECT?<br>A)

Q56: Changes in net working capital should not

Q69: Taggart Inc. is considering a project that

Q84: Trade credit can be separated into two

Q302: <span class="ql-formula" data-value="\int _ { 0 }

Q304: <span class="ql-formula" data-value="\int x ^ { n