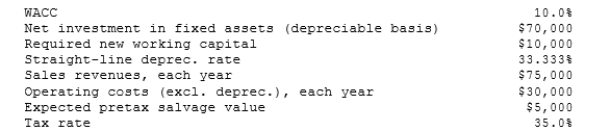

Foley Systems is considering a new investment whose data are shown below. The equipment would be depreciated on a straight-line basis over the project's 3-year life, would have a zero salvage value, and would require some additional working capital that would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's life. What is the project's NPV? (Hint: Cash flows are constant in Years 1 to 3.)

Definitions:

Financial Practices

The methods, strategies, and operations used by an organization or individual to manage their financial resources and records.

Voting Control

The power to influence or determine outcomes within an organization through the possession of voting shares or rights.

Durability

The ability of a product or material to withstand wear, pressure, or damage, maintaining its original form and functionality over time.

Barriers to Entry

Factors that make it difficult for new competitors to enter a market, protecting existing players from potential new entrants.

Q1: Kohers Inc. is considering a leasing arrangement

Q4: y = -mx

Q7: Simonyan Inc. forecasts a free cash flow

Q8: Even if a stock split has no

Q12: Which of the following could explain why

Q17: Money markets are markets for<br>A) Foreign stocks.<br>B)

Q19: When evaluating a new project, firms should

Q48: Which of the following is <u>NOT</u> a

Q81: Margetis Inc. carries an average inventory of

Q94: On average, a firm collects checks totaling