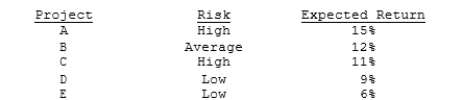

Langston Labs has an overall (composite) WACC of 10%, which reflects the cost of capital for its average asset. Its assets vary widely in risk, and Langston evaluates low-risk projects with a WACC of 8%, average-risk projects at 10%, and high-risk projects at 12%. The company is considering the following projects:  Which set of projects would maximize shareholder wealth?

Which set of projects would maximize shareholder wealth?

Definitions:

Reaction Formation

A defense mechanism where an individual behaves in a manner opposite to their actual feelings, often to hide their true emotions.

Pornography

Material intended to cause sexual arousal that depicts sexual content in a manner designed to elicit or enhance sexual feelings.

Erogenous Zones

Areas of the human body that are particularly sensitive to stimulation and can lead to sexual arousal.

Psychosexual Stages

Psychosexual stages are a series of developmental phases in psychoanalytic theory, proposed by Freud, that children pass through, each characterized by different modes of seeking pleasure.

Q7: If a firm wants to maintain its

Q8: A congeneric merger is one where the

Q8: At the current batch sizes, the bottleneck

Q10: A conservative current operating asset financing approach

Q16: Europa Corporation is financing an ongoing construction

Q25: Which of the following statements is CORRECT?<br><br>A) Under

Q33: The rate used to discount projected merger

Q37: Provided a firm does not use an

Q57: If a firm has set up a

Q117: Which of the following items should a