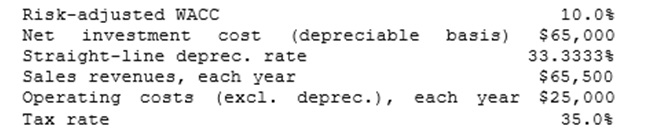

Temple Corp. is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life, would be depreciated by the straight-line method over its 3-year life, and would have a zero salvage value. No new working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV?

Definitions:

Predetermined Overhead Rate

A rate used to allocate manufacturing overhead to individual products or job orders, calculated before the production period begins based on estimated costs.

Direct Labour Hours

The total hours worked by employees directly involved in the manufacturing process, affecting the overall production cost.

Actual Manufacturing Overhead

The total of all actual indirect costs incurred in the production process, not directly tied to a specific product.

Job-Order Cost Sheets

Documents that track the expenses associated with manufacturing a specific job, including materials, labor, and overhead.

Q1: Which of the following statements is <u><b>NOT</b></u>

Q2: <span class="ql-formula" data-value="\int \frac { 4 x

Q3: The optimal distribution policy strikes that balance

Q6: If a firm's suppliers stop offering discounts,

Q7: Solve the initial value problem

Q8: Which of the following statements is CORRECT?<br>A)

Q10: Which of the following statements is CORRECT?<br>A)

Q69: Taggart Inc. is considering a project that

Q157: Find the length of the curve

Q283: <span class="ql-formula" data-value="\int _ { - \pi