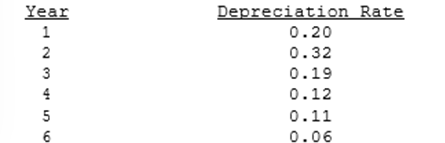

Marshall-Miller & Company is considering the purchase of a new machine for $50,000, installed. The machine has a tax life of 5 years, and it can be depreciated according to the following rates. The firm expects to operate the machine for 4 years and then to sell it for $12,500. If the marginal tax rate is 40%, what will the after-tax salvage value be when the machine is sold at the end of Year 4?

Definitions:

Q6: The cost of meeting SEC and possibly

Q8: Which of the following would <u>increase</u> the

Q13: The term "equity carve-out" refers to the

Q18: Suppose Yon Sun Corporation's free cash flow

Q22: Value-based management focuses on sales growth, profitability,

Q28: Firms pay a low interest rate on

Q33: Now assume that BB is considering changing

Q35: Exchange rate quotations consist solely of direct

Q44: Clemson Software is considering a new project

Q273: <span class="ql-formula" data-value="\int \frac { x ^