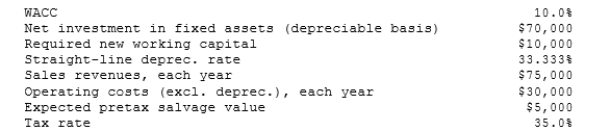

Foley Systems is considering a new investment whose data are shown below. The equipment would be depreciated on a straight-line basis over the project's 3-year life, would have a zero salvage value, and would require some additional working capital that would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's life. What is the project's NPV? (Hint: Cash flows are constant in Years 1 to 3.)

Definitions:

Nash Equilibrium

A concept within game theory where no participant can gain by changing strategies if the strategies of the others remain unchanged.

AMD

Advanced Micro Devices, Inc., an American multinational semiconductor company that develops computer processors and related technologies.

Intel

A multinational corporation and technology company known primarily for its semiconductor chips used in computer systems.

Time-Discounted Profits

The present value of future profits, taking into account the time value of money and the preference for receiving profits earlier rather than later.

Q1: Which of the following statements is CORRECT?<br>A) Net

Q10: Which of the following statements is CORRECT?<br>A)

Q20: Companies HD and LD have identical tax

Q31: A firm buys on terms of 3/15,

Q36: A local pond can only hold

Q40: <span class="ql-formula" data-value="\int \frac { \tan ^

Q47: DeLong Inc. has fixed operating costs of

Q64: BB is considering moving to a capital

Q65: Which of the following statements is CORRECT?<br>A)

Q375: <span class="ql-formula" data-value="\sqrt { 49 - x