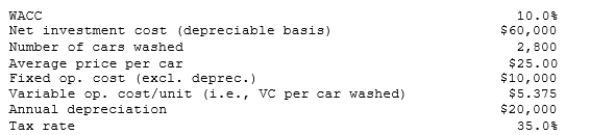

Poulsen Industries is analyzing an average-risk project, and the following data have been developed. Unit sales will be constant, but the sales price should increase with inflation. Fixed costs will also be constant, but variable costs should rise with inflation. The project should last for 3 years, it will be depreciated on a straight- line basis, and there will be no salvage value. This is just one of many projects for the firm, so any losses can be used to offset gains on other firm projects. The marketing manager does not think it is necessary to adjust for inflation since both the sales price and the variable costs will rise at the same rate, but the CFO thinks an adjustment is required. What is the difference in the expected NPV if the inflation adjustment is made vs. if it is not made?

Definitions:

Journal Entries

Records of financial transactions in the accounting system.

Impairment Loss

The amount by which the carrying amount of an asset exceeds its recoverable amount, leading to a decrease in the asset's value on the financial statements.

International Financial Reporting Standards

A set of global accounting standards developed by the International Accounting Standards Board, aiming to bring transparency, accountability, and efficiency to financial markets around the world.

Significant Influence

The power to participate in the financial and operating policy decisions of an investee, but not control those policies, typically evidenced by ownership of 20% to 50% of the voting stock.

Q10: What would be the costs of direct

Q15: A synthetic lease is a combination of

Q17: What is the Return on Invested Capital

Q29: <span class="ql-formula" data-value="\int _ { 2 }

Q61: Fernando Designs is considering a project that

Q63: <span class="ql-formula" data-value="y ^ { \prime }

Q64: BB is considering moving to a capital

Q74: A promissory note is the document signed

Q211: <span class="ql-formula" data-value="\int \frac { d x

Q272: Find the area between y =