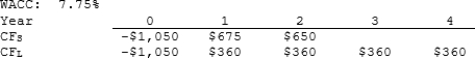

Kosovski Company is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and are not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under some conditions choosing projects on the basis of the IRR will cause

$0) 00 value to be lost.

Definitions:

Q4: <span class="ql-formula" data-value="\int \frac { \ln x

Q7: Firms hold cash balances in order to

Q21: Which batch size for the stamping machine

Q46: Firms with high capital intensity ratios have

Q51: Dabney Electronics currently has no debt. Its

Q64: The IRR method is based on the

Q93: A firm's collection policy, i.e., the procedures

Q124: <span class="ql-formula" data-value="\int _ { 0 }

Q141: <span class="ql-formula" data-value="\int \frac { d x

Q301: <span class="ql-formula" data-value="\frac { y + 2