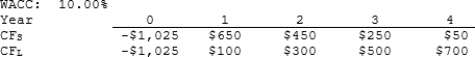

Moerdyk & Co. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the project with the higher IRR will also have the higher NPV, i.e., no conflict will exist.

Definitions:

Federal Aviation Administration

A United States government agency responsible for regulating all aspects of civil aviation in the U.S.

National Labor Relations Board

An independent U.S. federal agency established in 1935 that enforces U.S. labor law in relation to collective bargaining and unfair labor practices.

Reagan Doctrine

A strategy implemented by the U.S. during the presidency of Ronald Reagan, aimed at diminishing the influence of the Soviet Union globally by supporting anti-communist resistance movements.

Anticommunist Forces

Individuals or groups that oppose communism, often advocating for or engaging in political or military action against communist movements or governments.

Q8: A firm's AFN must come from external

Q31: <span class="ql-formula" data-value="\int \mathrm { e }

Q32: Zervos Inc. had the following data for

Q38: The minimum growth rate that a firm

Q56: <span class="ql-formula" data-value="4 y ^ { \prime

Q125: Find an upper bound for

Q355: <span class="ql-formula" data-value="\int _ { 0 }

Q418: <span class="ql-formula" data-value="\int \frac { \sqrt {

Q449: <span class="ql-formula" data-value="x \frac { d y

Q457: <span class="ql-formula" data-value="\int \frac { d x