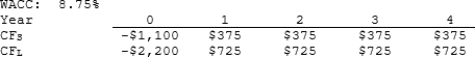

Nast Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV, how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.

Definitions:

Debt Securities

Financial instruments representing money borrowed that must be repaid, such as bonds, bills, or notes.

Available-for-Sale Securities

Financial assets that a company intends to sell within a short period but can hold onto for an indefinite period, classified as neither held for trading nor held to maturity.

Realizable Securities

Financial assets that can be quickly converted into cash with a known market price.

Unrealized Loss

A decrease in the value of an investment that has not yet been sold and therefore not yet recognized as a loss in the accounts.

Q10: If the information content, or signaling, hypothesis

Q17: Two important issues in corporate governance are

Q21: The risk to the firm of borrowing

Q25: Which of the following is <u>NOT</u> a

Q66: Ang Enterprises has a levered beta of

Q78: Long-term loan agreements always contain provisions, or

Q81: <span class="ql-formula" data-value="y ^ { \prime }

Q86: A 57-kg skateboarder on a 2-kg board

Q222: <span class="ql-formula" data-value="\int \frac { 2 x

Q269: <span class="ql-formula" data-value="\int \sin 4 t \sin