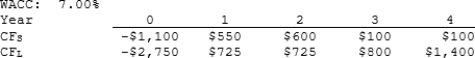

Noe Drilling Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates the MIRR. If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR, how much, if any, value will be forgone. In other words, what's the NPV of the chosen project versus the maximum possible NPV? Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs. MIRR will have no effect on the value lost.

Definitions:

Fixed Manufacturing Overhead

Costs that do not vary with the level of production, such as rent, salaries, and insurance associated with manufacturing.

Variances

Differences between expected and actual performance in business metrics such as costs, revenues, and production levels.

Direct Labor-Hours

The total hours worked by employees directly involved in manufacturing goods or providing services.

Standard Costs

Pre-determined costs used as a benchmark for evaluating actual production costs within a business.

Q1: Which server is the bottleneck of the

Q5: Which of the following statements is CORRECT?<br><br>A) Depreciation

Q12: Consider a customer with a complex case<br>A)16

Q13: Exchange rate risk is the risk that

Q16: Blemker Corporation has $500 million of total

Q22: The station manager is considering the option

Q47: Affleck Inc.'s business is booming, and it

Q90: <span class="ql-formula" data-value="\int \frac { d x

Q110: Cash is often referred to as a

Q368: <span class="ql-formula" data-value="\int \frac { \sqrt {