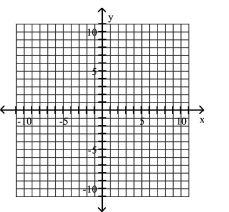

Graph the inequality.

-

Definitions:

MM Model

This refers to the Modigliani-Miller theorem, a foundational element of corporate finance theory that proposes, under certain conditions, the value of a firm is unaffected by how it is financed.

Corporate Taxes

Taxes imposed on the income or profit of corporations by the government, affecting the company's net income and cash flow.

Miller Model

A theory that incorporates corporate taxes and bankruptcy costs to determine the optimal capital structure for a firm.

Trade-Off Theory

The addition of financial distress and agency costs to either the MM tax model or the Miller model. When trade-off is added to either model, the optimal capital structure can be visualized as a trade-off between the benefit of debt (the interest tax shield) and the costs of debt (financial distress and agency costs).

Q19: <span class="ql-formula" data-value="\begin{array} { l } y

Q19: <span class="ql-formula" data-value="\frac { x ^ {

Q21: The owner of a video store

Q33: The total cost in dollars for a

Q65: <span class="ql-formula" data-value="\begin{array}{l}4 x-y \leq-4 \\x+2 y

Q79: {(-2, 6), (-1, 3), (0, 2), (1,

Q84: <span class="ql-formula" data-value="f ( x ) =

Q105: <span class="ql-formula" data-value="y>x^{2}-3"><span class="katex"><span class="katex-mathml"><math xmlns="http://www.w3.org/1998/Math/MathML"><semantics><mrow><mi>y</mi><mo>></mo><msup><mi>x</mi><mn>2</mn></msup><mo>−</mo><mn>3</mn></mrow><annotation encoding="application/x-tex">y>x^{2}-3</annotation></semantics></math></span><span

Q157: <span class="ql-formula" data-value="\log \left( \frac { x

Q239: <span class="ql-formula" data-value="f ( x ) =